Table of Content

The rule of 55 allows certain workers to withdraw money early from employer-sponsored retirement accounts without triggering a tax penalty. Homebuyers can use homeownership programs offered by the federal government to encourage homeownership, such as Federal Housing Administration and U.S. These programs offer lower down payments and have less stringent credit requirements.

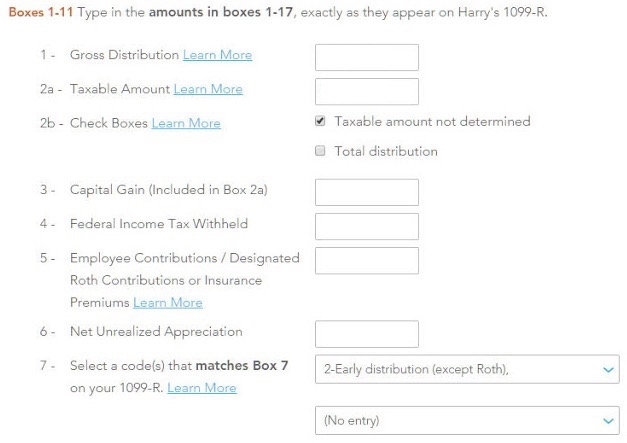

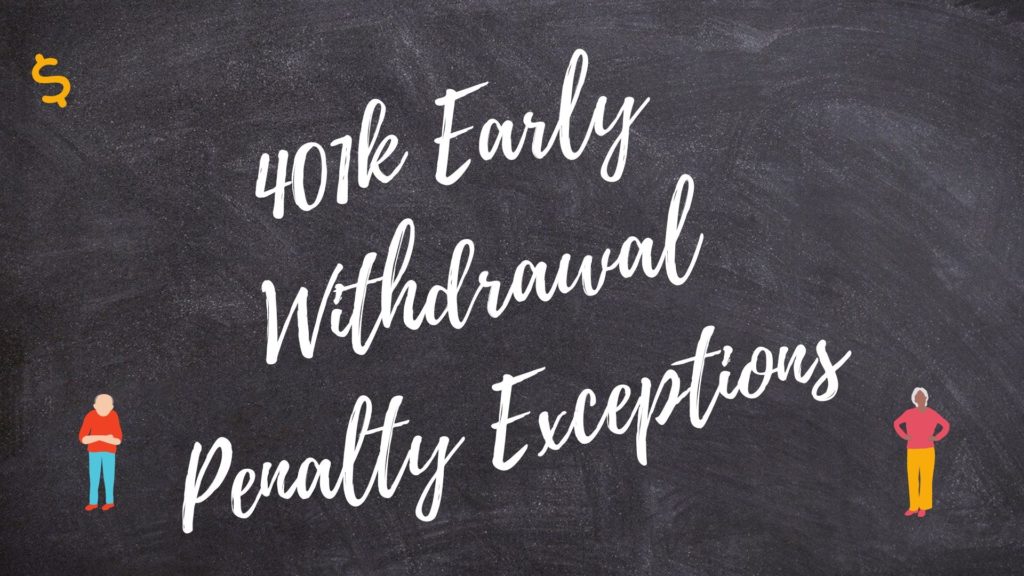

David has helped thousands of clients improve their accounting and financial systems, create budgets, and minimize their taxes. The withdrawal process is somewhat easier with other retirement accounts. If you’re getting crushed by inflation and you have any money sitting in your 401, you may be wondering how you can get at it. In that kind of situation, something called a “hardship withdrawal” sounds like it would fit the bill. There’s little wiggle room in IRS rules for hardship withdrawals. While using your 401K may seem like an easy solution, you can pay steep penalties—not to mention the fact that you’ll be depleting your retirement savings.

Is using 401k to buy a house a good idea?

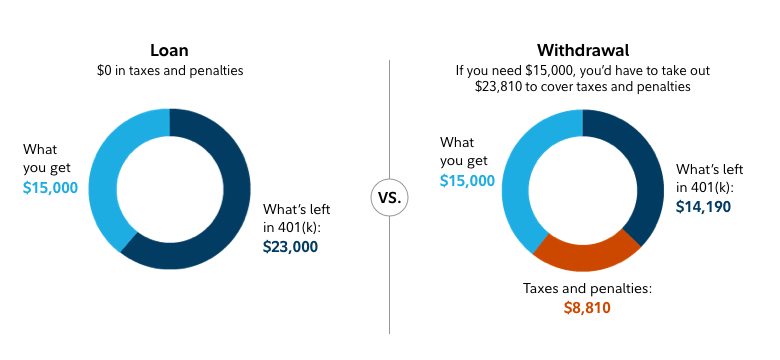

The information on Investor Junkie could be different from what you find when visiting a third-party website. A 401 loan will likely not negatively affect your mortgage loan approval because it's not usually counted in your debt-to-income ratio. And since the loans are not reported to credit bureaus, the loan won’t affect your credit score. A loan is easier to do than a withdrawal for the purpose of a home down payment.

The money would be used for a home purchase, but I have not had my Roth IRA for 5 years so the first time home buyer exception would not apply here. In certain rare circumstances, in the case of an “immediate and heavy financial need,” the IRS will allow you to make a 401 hardship withdrawal to purchase a primary residence. Hardship withdrawals do not cover mortgage payments, but using a 401 for a down payment for a first-time home buyer could be allowed.

How Can I Use My 401(k) to Purchase a Home?

Better yet, work with a SmartVestor Pro to make sure your investments are on track to meet your retirement goals. If you are an eligible service member, a veteran or the spouse of one, then a Department of Veterans Affairs loan could be a better alternative to withdrawing from your 401 account. Withdrawing from your 401 account is essentially taking out a loan against yourself. If you want to pay it back, you also need to pay interest, and the time spent paying it back is time that could have been spent on growth. We’ll break down the pros and cons of making a 401 withdrawal for a home purchase, as well as some alternatives. For example, you may be able to put down as little as 3.5% with an FHA loan.

This in-depth article on 401k loans reviews how home buyers can borrow from a 401k for a down payment, why home buyers shouldn’t, and alternatives to consider. Advisory services are offered through SoFi Wealth LLC, an SEC-registered investment adviser. When shopping for a mortgage, you want the best interest rate while avoiding hefty fees.

withdrawals for home purchase: Is it possible?

That means your employer won’t be matching any contributions, either. Taking out a loan essentially puts a freeze on your 401 until it’s been paid in full. Depending on how long that takes, you could miss out on years of growth. While these regulations may seem harsh, they are in place to incentivize account holders to set aside enough money to support a comfortable retirement.

There are fees and taxes involved, and they’re pretty hefty. An early withdrawal would be classified as a hardship withdrawal. The IRS considers any emergency removal of funds from a 401 to cover “an immediate and heavy financial need” as a hardship withdrawal. The maximum amount allowed to be withdrawn in a 401 loan is $50,000. It must be paid back with interest, typically between1 – 2%, and you won’t be able to make additional contributions to your 401 account until the loan amount has been repaid.

How To Save Up For A House Down Payment

Not all employers offer 401 loans as an option in their retirement plans, though. It’s also important to note that you are still required to repay the loan even if you leave your current job or are laid off. In fact, your repayment period shortens once that happens, and the loan must be repaid in full by the next tax filing date. Homebuyers who borrow from their 401 plans can’t make additional contributions to the accounts or receive matching contributions from their employers while paying off the loan. Depending on how much they were contributing, these home buyers could miss out on years of retirement contributions while they’re paying back the loan. That could take a substantial bite out of their overall retirement savings.

If you have that money in a 401k, then a 401k loan is a feasible option for avoiding this added expense. The information in this article does not constitute financial planning advice. Please consult a financial planner regarding your specific situation. Please consult a tax advisor regarding your specific situation. Eligibility to programs mentioned are subject to program stipulations, qualifying factors, applicable income and debt-to-income restrictions, and property limits. These materials are not from HUD or FHA and were not approved by HUD or a government agency.

Research down payment assistance.Many states and local governments offer down payment assistance programs. These programs often come in the form of down payment grants or loans. They are specific to your location, so you must research their requirements. In general, you will need to make below a specific income limit. In fact, it’s most likely one of the largest purchases you’ll make in your lifetime. You may be tempted to make a 401 withdrawal for a home purchase, especially if you need to make the down payment.

In withdrawing from your 401k, you’ll have to pay income tax on the withdrawals and if you’re under 59 ½, you’ll incur a 10% penalty on the withdrawn funds. Under these provisions, first-time home buyers are allowed to withdraw up to $10,000 without incurring the 10% penalty. However, that $10,000 is still subject to state and federal income taxes.

You can use your 401 toward buying a house and avoid this fee. However, a 401 withdrawal for a home purchase may not be best for some buyers because of the opportunity cost. Nevertheless, hardship withdrawals are increasing by an alarming amount, according to new data from 401 custodians. At Vanguard, hardship withdrawals reached a “concerning” record high, outpacing increases in loans and non-hardship withdrawals from retirement accounts. Fidelity and Ubiquity also noted an increase in all three areas.